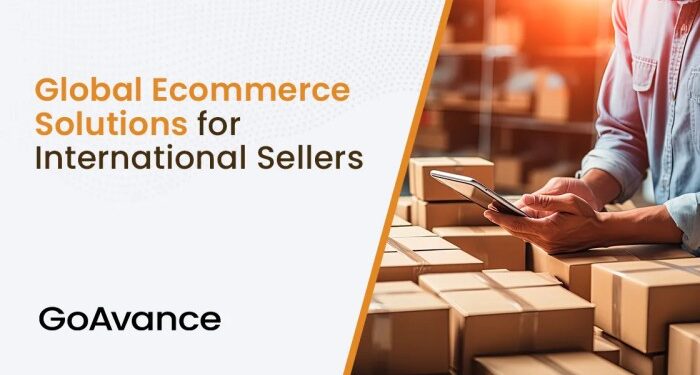

In the ever-expanding realm of global eCommerce, having affordable merchant solutions is crucial for businesses to thrive and succeed. This guide delves into the intricacies of cost-effective solutions tailored for the international market, offering insights and strategies to propel businesses towards global success.

As we explore the various facets of affordable merchant solutions, you'll uncover essential information to navigate the dynamic landscape of global eCommerce with confidence and efficiency.

Overview of Affordable Merchant Solutions for Global eCommerce

Affordable merchant solutions in the context of global eCommerce refer to cost-effective payment processing services, tools, and technologies that enable businesses to accept online payments from customers worldwide. These solutions help streamline the payment process, reduce transaction fees, and provide a seamless checkout experience for customers.

Having cost-effective merchant solutions is crucial for businesses operating in the global eCommerce sector as it allows them to lower operational costs, increase profit margins, and remain competitive in the market. By minimizing transaction fees and other related expenses, businesses can allocate more resources towards marketing, product development, and customer service.

Importance of Affordable Merchant Solutions

- Affordable merchant solutions can help businesses of all sizes, especially small and medium-sized enterprises (SMEs), to enter and compete in the global market.

- By providing secure and reliable payment processing options at a lower cost, businesses can attract more international customers and increase sales.

- Cost-effective solutions also foster customer trust and loyalty, as they offer a convenient and hassle-free payment experience.

- With affordable merchant solutions, businesses can expand their reach, tap into new markets, and diversify their revenue streams without breaking the bank.

Types of Affordable Merchant Solutions

When it comes to global eCommerce, there are several types of affordable merchant solutions that businesses can utilize to process payments efficiently. Let's explore some of these options and compare their features.

Payment Gateways

- Features:Payment gateways are online tools that securely transmit customer payment information to the merchant account for processing. They often offer fraud protection, multiple payment options, and integration with popular eCommerce platforms.

- Examples:Some popular payment gateway providers include PayPal, Stripe, and Square.

Merchant Accounts

- Features:Merchant accounts are bank accounts that allow businesses to accept payments via credit or debit cards. They provide features like transaction processing, fraud prevention, and settlement of funds to the business's bank account.

- Examples:Merchant account providers like Authorize.Net, Worldpay, and Payline offer solutions for businesses of all sizes.

Other Payment Processing Solutions

- Features:Other payment processing solutions include mobile payment options, virtual terminals, and point-of-sale systems. These solutions cater to businesses with specific needs or preferences for payment acceptance.

- Examples:Companies like Square, Shopify, and 2Checkout offer a variety of payment processing solutions tailored to different business models.

Considerations when Choosing Affordable Merchant Solutions

When selecting affordable merchant solutions for global eCommerce, businesses must carefully consider several key factors to ensure the effectiveness and success of their payment processing operations.

Importance of Security, Scalability, and Ease of Integration

- Security: It is crucial to prioritize the security of payment transactions to protect sensitive customer information. Look for solutions with robust security measures such as encryption and fraud detection.

- Scalability: Consider the scalability of the merchant solution to accommodate the growth of your business. Choose a solution that can easily scale up to handle increased transaction volumes.

- Integration: Seamless integration with your existing eCommerce platform and other systems is essential for smooth operations. Opt for solutions that offer easy integration options to minimize disruptions.

Evaluating Cost-Effectiveness Based on Specific Needs

- Assess Your Requirements: Determine your business's specific payment processing needs and evaluate how different merchant solutions align with those requirements.

- Compare Pricing Models: Consider the pricing structures of different merchant solutions, including transaction fees, monthly subscriptions, and any additional charges. Choose a solution that offers transparent and cost-effective pricing.

- ROI Analysis: Conduct a thorough ROI analysis to determine the long-term cost-effectiveness of each merchant solution. Factor in potential savings, efficiency gains, and revenue growth opportunities.

Implementing Affordable Merchant Solutions for Global eCommerce

Integrating affordable merchant solutions into an existing eCommerce platform is a crucial step for businesses looking to optimize payment processing workflows and improve customer experience. By following best practices, businesses can maximize efficiency and cost savings while streamlining cross-border transactions.

Optimizing Payment Processing Workflows

When implementing affordable merchant solutions, it is essential to optimize payment processing workflows to maximize efficiency and cost savings. Some best practices to consider include:

- Utilizing secure payment gateways to protect customer data and prevent fraud.

- Automating recurring payments to reduce manual processes and improve cash flow.

- Implementing multi-currency support to accommodate customers from different regions and streamline cross-border transactions.

- Regularly reviewing and updating payment processing workflows to ensure they are aligned with business goals and industry standards.

Streamlining Cross-Border Transactions

Businesses can leverage affordable merchant solutions to streamline cross-border transactions and improve customer experience. By implementing the following strategies, businesses can reduce friction in international payments:

- Offering multiple payment methods to cater to the preferences of customers in different regions.

- Implementing fraud protection measures to safeguard transactions and build trust with customers.

- Partnering with local payment processors to reduce fees and optimize currency conversion rates.

- Providing transparent pricing and clear communication to customers regarding any additional charges or fees associated with cross-border transactions.

Epilogue

With a focus on Affordable Merchant Solutions for Global eCommerce, this guide has unraveled the complexities and highlighted the key benefits for businesses venturing into the realm of international trade. Armed with this knowledge, businesses can now make informed decisions to optimize their operations and expand their global footprint.

FAQ Compilation

What are affordable merchant solutions?

Affordable merchant solutions in the context of global eCommerce refer to payment processing services and tools that offer cost-effective options for businesses to manage transactions internationally.

How can small businesses benefit from affordable merchant solutions?

Small businesses can benefit from affordable merchant solutions by reducing transaction costs, expanding their customer base globally, and improving overall operational efficiency.

What factors should businesses consider when choosing affordable merchant solutions?

Businesses should consider factors such as security, scalability, ease of integration, transaction fees, and customer support when selecting affordable merchant solutions for global eCommerce.

How can businesses optimize payment processing workflows with affordable merchant solutions?

Businesses can optimize payment processing workflows by automating processes, integrating with reliable payment gateways, and leveraging analytics to track and improve transaction performance.

Which are some popular affordable merchant solution providers in the market?

Popular affordable merchant solution providers include PayPal, Stripe, Square, Worldpay, and Authorize.Net, offering a range of services tailored for global eCommerce needs.