Exploring the realm of Best Merchant Service Providers for Online Stores, this introduction sets the stage for a comprehensive discussion on how to optimize your online business transactions. From seamless payments to robust security measures, get ready to dive into the world of merchant services.

Introduction to Merchant Service Providers

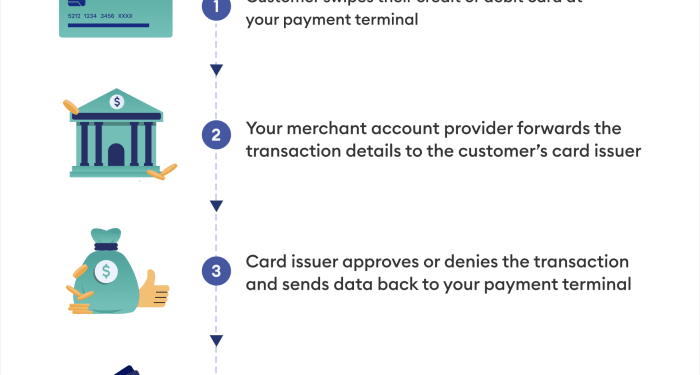

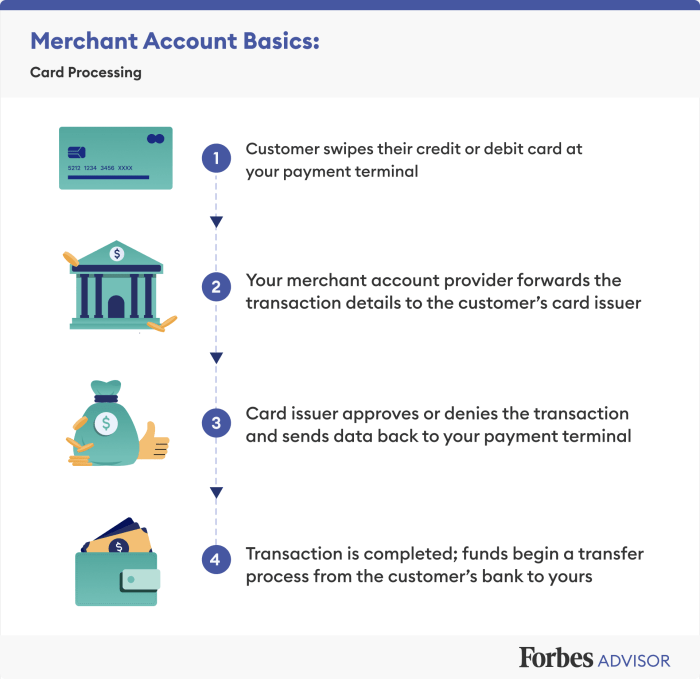

Merchant service providers play a crucial role in enabling online stores to accept and process payments securely from customers. These providers act as the bridge between the online store, the payment gateway, and the customer's financial institution.

Choosing the best merchant service provider is essential for ensuring smooth and seamless transactions on your online store. The right provider can help enhance customer experience, increase conversion rates, and build trust with your audience.

Key Features to Look for in a Merchant Service Provider

- Secure Payment Processing: Look for providers that offer robust security measures to protect sensitive customer data and prevent fraud.

- Multiple Payment Options: Ensure the provider supports a wide range of payment methods to cater to diverse customer preferences.

- Competitive Pricing: Compare fees and rates from different providers to find a cost-effective solution that fits your budget.

- Integration Capabilities: Choose a provider that seamlessly integrates with your e-commerce platform for a hassle-free setup.

- 24/7 Customer Support: Opt for a provider that offers round-the-clock customer support to address any issues promptly.

Top Features to Consider

When choosing a merchant service provider for your online store, it's crucial to consider various features that can impact the efficiency and security of your payment processing system.

Payment Gateway Integrations

One of the most essential features to consider is the availability of payment gateway integrations. A robust payment gateway allows you to accept a wide range of payment methods, including credit cards, digital wallets, and alternative payment options. Ensure that the merchant service provider supports popular payment gateways to cater to a diverse customer base.

Fraud Protection and Security Measures

Fraud protection and security measures are paramount when it comes to processing online transactions. Look for a merchant service provider that offers advanced security features such as encryption, tokenization, and fraud detection tools. These measures help safeguard sensitive customer data and prevent fraudulent activities, instilling trust in your online store.

Scalability and Flexibility in Payment Processing

Another important feature to consider is the scalability and flexibility of the payment processing system. As your online store grows, you may need to handle a higher volume of transactions and adapt to changing payment trends. Choose a merchant service provider that can scale with your business and offers flexible payment solutions to meet your evolving needs.

Popular Merchant Service Providers

When it comes to choosing a merchant service provider for your online store, some of the top names in the industry include PayPal, Square, and Stripe. Each of these providers offers unique features and pricing structures that cater to different business needs.

PayPal

- PayPal is a widely recognized and trusted payment solution used by millions of customers worldwide.

- They offer a variety of payment options, including credit cards, debit cards, and PayPal Credit.

- PayPal's pricing structure includes a transaction fee and a percentage of the sale amount.

Square

- Square is known for its user-friendly interface and easy setup process, making it a popular choice for small businesses.

- They offer transparent pricing with a flat rate per transaction, making it easy for businesses to calculate costs.

- Square also provides additional features such as inventory management and sales reporting tools.

Stripe

- Stripe is a flexible payment processor that allows businesses to customize their payment solutions to suit their needs.

- They offer competitive pricing with a flat fee per transaction and no setup or monthly fees.

- Stripe is known for its developer-friendly tools and seamless integration options with various e-commerce platforms.

Integration with E-commerce Platforms

Integrating merchant services with popular e-commerce platforms like Shopify, WooCommerce, and Magento is crucial for online store owners looking to streamline their payment process and enhance the overall shopping experience for customers.

Shopify Integration

Shopify offers seamless integration with a wide range of merchant service providers, allowing for easy setup and configuration of payment gateways. By connecting your Shopify store with a merchant service provider, you can accept various payment methods securely and efficiently.

WooCommerce Integration

WooCommerce, being a WordPress plugin, provides flexibility in integrating with different merchant service providers. With WooCommerce, you can easily set up payment gateways and manage transactions directly from your online store. This integration ensures a smooth checkout process for your customers.

Magento Integration

Magento is known for its robust e-commerce capabilities, including integration with various merchant service providers. By connecting Magento with a merchant service provider, you can offer multiple payment options to customers and manage transactions effectively. This integration is essential for providing a seamless shopping experience.

Customer Support and Reputation

Customer support plays a crucial role in the overall success of an online store. It is essential to have reliable support from merchant service providers to address any issues or inquiries promptly. Here, we will delve into the importance of customer support and how to evaluate the reputation of different providers.

Importance of Reliable Customer Support

Having reliable customer support ensures that any technical difficulties or payment processing issues are resolved quickly, minimizing disruptions to the online shopping experience. It also helps in building trust with customers, as they know they can count on prompt assistance when needed.

Evaluating Provider Reputation

There are several ways to evaluate the reputation and customer feedback of different merchant service providers. One way is to check online reviews and ratings on trusted platforms like Trustpilot or BBB. Additionally, you can ask for referrals from other online store owners who have experience with a particular provider.

Impact on Online Store Experience

Good customer support can significantly enhance the overall online store experience for both merchants and customers. It ensures smooth transactions, resolves issues efficiently, and fosters a positive relationship between the merchant and the service provider. On the other hand, poor customer support can lead to frustrated customers, lost sales, and damage to the store's reputation.

Final Review

In conclusion, navigating the landscape of Best Merchant Service Providers for Online Stores can be a game-changer for your e-commerce success. By focusing on key features, top providers, and integration tips, you're equipped to elevate your online store to new heights of efficiency and customer satisfaction.

FAQ Explained

What are the key features to look for in a merchant service provider?

Key features include seamless payment processing, robust security measures, and scalability for future growth.

Which are the top merchant service providers besides PayPal, Square, and Stripe?

Other top providers include Authorize.Net, Adyen, and Braintree, each with its own unique advantages.

How can I evaluate the reputation of a merchant service provider?

You can evaluate reputation through online reviews, ratings on platforms like Trustpilot, and feedback from other businesses who have used the service.

What impact does customer support have on the overall online store experience?

Customer support plays a crucial role in resolving issues quickly, ensuring smooth transactions, and building trust with customers.