In the realm of small business finance, Shopify Capital Loan Tips for Small Business Owners emerge as a beacon of financial guidance. This guide is designed to shed light on the intricacies of Shopify Capital Loans, offering valuable insights and practical advice for entrepreneurs navigating the world of business funding.

This guide will delve into the eligibility criteria, application process, pros and cons, fund management strategies, repayment options, and more, providing a holistic view of how small business owners can make the most of Shopify Capital Loans.

Introduction to Shopify Capital Loans

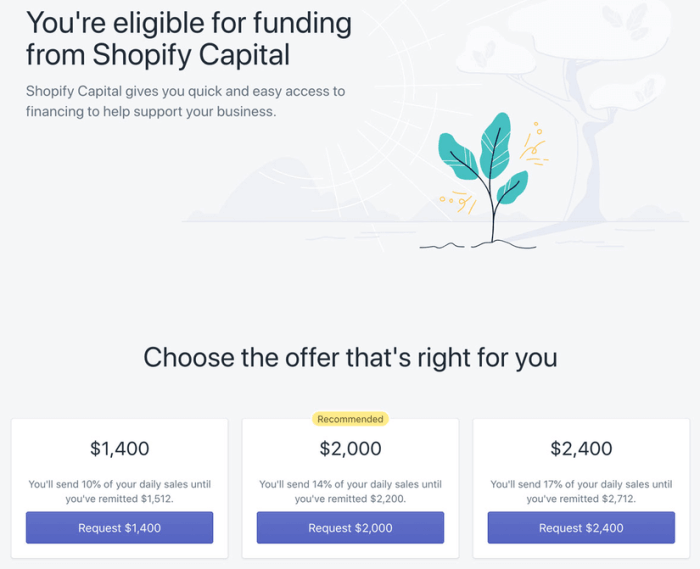

Shopify Capital Loans are financial assistance programs offered by Shopify to help small business owners grow and expand their businesses. These loans provide a quick and easy way for entrepreneurs to access the capital they need to invest in inventory, marketing, equipment, or any other business needs.

Eligibility Criteria for Shopify Capital Loans

In order to qualify for a Shopify Capital Loan, small business owners must meet certain eligibility criteria. These criteria typically include having a Shopify store that meets specific sales requirements, a history of successful sales, and other factors that demonstrate the business's ability to repay the loan.

Application Process for Shopify Capital Loans

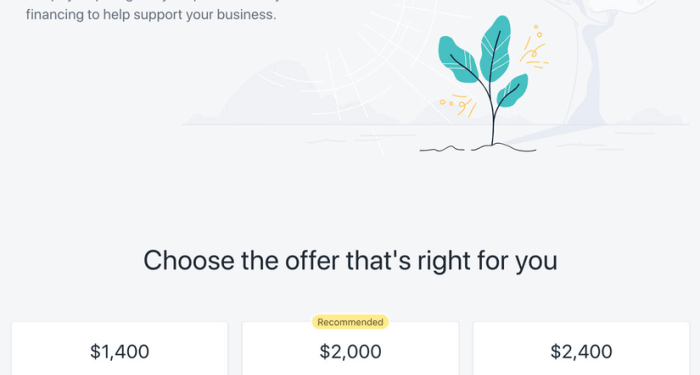

Applying for a Shopify Capital Loan is a straightforward process. Once eligible, business owners can access their loan offers directly through their Shopify dashboard. The application process is simple and streamlined, with quick approval and funding to help entrepreneurs access the capital they need without the hassle of traditional loan applications.

Pros and Cons of Shopify Capital Loans

Shopify Capital Loans can be a great option for small businesses looking for quick and flexible funding. However, like any financial product, there are both advantages and disadvantages to consider before making a decision.

Advantages of Shopify Capital Loans

- Quick Approval Process: Shopify Capital Loans have a streamlined application process, allowing small business owners to access funds quickly.

- No Fixed Monthly Payments: Unlike traditional bank loans, Shopify Capital Loans are repaid through a percentage of daily sales, making it easier to manage cash flow.

- No Credit Check: Shopify looks at your sales history on their platform, rather than your credit score, making it easier for businesses with less-than-perfect credit to qualify.

- No Personal Guarantee: Small business owners are not required to put up personal assets as collateral for a Shopify Capital Loan.

Drawbacks of Shopify Capital Loans

- Higher Fees: Shopify Capital Loans may come with higher fees compared to traditional bank loans, which could impact the overall cost of borrowing.

- Revenue Sharing: Since repayments are based on a percentage of daily sales, businesses may end up paying more in times of high sales volume.

- Limited Loan Amounts: Shopify Capital Loans typically offer smaller loan amounts compared to traditional bank loans, which may not meet the funding needs of larger businesses.

Comparison with Traditional Bank Loans

When comparing Shopify Capital Loans with traditional bank loans, it's important to consider the ease of access and flexibility each option offers. While traditional bank loans may have lower interest rates and longer repayment terms, they often come with stricter eligibility requirements and a longer approval process.

On the other hand, Shopify Capital Loans provide quick access to funding with minimal paperwork and no credit check, making them a viable option for small businesses in need of immediate capital.

Managing Funds from a Shopify Capital Loan

When small business owners receive a Shopify Capital Loan, it is essential to have a clear plan on how to effectively manage the funds to ensure maximum impact on business growth and development.

Strategies for Effective Fund Management

- Identify Specific Goals: Clearly define how the funds will be utilized to achieve specific business objectives such as expanding inventory, launching marketing campaigns, or upgrading equipment.

- Create a Budget: Develop a detailed budget outlining how the loan funds will be allocated to different areas of the business to avoid overspending or mismanagement.

- Monitor Cash Flow: Keep a close eye on cash flow to ensure that the loan funds are being utilized efficiently and effectively to generate revenue and cover expenses.

- Reinvest Profits: Consider reinvesting profits generated from the loan funds back into the business to fuel further growth and sustainability.

Successful Utilization of Shopify Capital Loans

Small businesses have successfully utilized Shopify Capital Loans in various ways to drive growth and development. For example, some businesses have used the funds to:

- Expand product lines and offerings to attract new customers and increase sales.

- Invest in marketing and advertising strategies to reach a wider audience and boost brand awareness.

- Upgrade technology and infrastructure to improve operational efficiency and customer experience.

- Hire additional staff or provide training to existing employees to enhance productivity and service quality.

Repayment Strategies for Shopify Capital Loans

When it comes to repaying a Shopify Capital Loan, it is essential for small business owners to have a solid plan in place. Failing to repay the loan on time can have serious consequences for the business, so it is crucial to carefully consider the repayment options available and create a strategy that aligns with the cash flow and revenue streams of the business.

Different Repayment Options

- Fixed Daily or Weekly Payments: This option involves making regular fixed payments either daily or weekly, which can help in budgeting and planning for the repayments.

- Percentage of Daily Sales: With this option, a percentage of the daily sales is automatically deducted to repay the loan, which can fluctuate based on the business's revenue.

- Monthly Payments: Some businesses may opt for monthly payments to simplify the repayment process and align it with their monthly financial cycle.

Creating a Repayment Plan

- Assess Cash Flow: Understand the business's cash flow patterns to determine the most suitable repayment option.

- Set Realistic Goals: Establish achievable repayment goals that do not strain the business's finances.

- Monitor Progress: Regularly track the repayment progress and make adjustments if needed to stay on track.

Consequences of Defaulting

- Impact on Credit Score: Defaulting on a Shopify Capital Loan can negatively affect the business's credit score, making it harder to secure future financing.

- Legal Action: In severe cases, the lender may take legal action to recover the outstanding amount, leading to additional costs and potential asset seizure.

- Reputation Damage: Defaulting on a loan can harm the business's reputation and credibility in the eyes of lenders and customers.

Closing Notes

As we conclude this exploration of Shopify Capital Loan Tips for Small Business Owners, it becomes evident that these financial tools hold immense potential for empowering entrepreneurs. By leveraging the tips and strategies shared in this guide, small business owners can navigate the complexities of funding with confidence and foresight, paving the way for sustained growth and success.

Questions and Answers

What are the eligibility criteria for applying for a Shopify Capital Loan?

To be eligible, a business must have a history of sales on Shopify, meet certain revenue requirements, and have no outstanding Shopify Capital Loans.

What are the potential drawbacks of Shopify Capital Loans for small business owners?

While Shopify Capital Loans offer quick funding, the fees can be higher compared to traditional loans, and the repayment terms may not suit all businesses.

How can small business owners effectively manage funds from a Shopify Capital Loan?

It's essential to create a detailed budget, track expenses, and use the funds strategically for business growth, such as investing in marketing or inventory.

What are the consequences of defaulting on a Shopify Capital Loan?

Defaulting can lead to Shopify withholding funds from future sales, negatively impacting cash flow and potentially damaging the business's credit.